Altcoinist Review: $MPL, Maple Finance

As observed by Fortunafi, the world may not yet fully grasp that Real World Assets (RWA) represent a $32 trillion opportunity by 2031, potentially becoming the largest and most significant application in crypto.

Altcoinist Review: MPL by Maple Finance - The Digital Wall Street of Lending

Total Loans Issued: $2.9 Billion

Total Value Locked: Over $100 Million

Circulating Supply: 79%

Maple Finance is noted for its innovative under-collateralized lending and integration with Real World Assets (RWA), decentralized revenue sharing, global accessibility, and competitive financial products. In the expanding future of tokenized RWAs and decentralized finance (DeFi), Maple Finance is emerging as a pivotal infrastructure player, well-matched to the market.

Its unique approach to under-collateralized lending for institutional entities within the RWA framework signifies a major shift from traditional, less efficient finance systems.

RWA Definition and Scope

RWAs involve the tokenization of tangible and productive assets within the DeFi ecosystem, covering a range of assets including real estate, emerging markets, and various forms of financing.

Maple Finance Introduction

Launched in May 2021, Maple Finance has established itself as a leading crypto lending protocol focusing on institutional investors, with over $2.05 billion in cumulative loans. The platform has raised $1.4 million, led by investors like Framework and Polychain Capital.

Maple Finance’s Operational Model

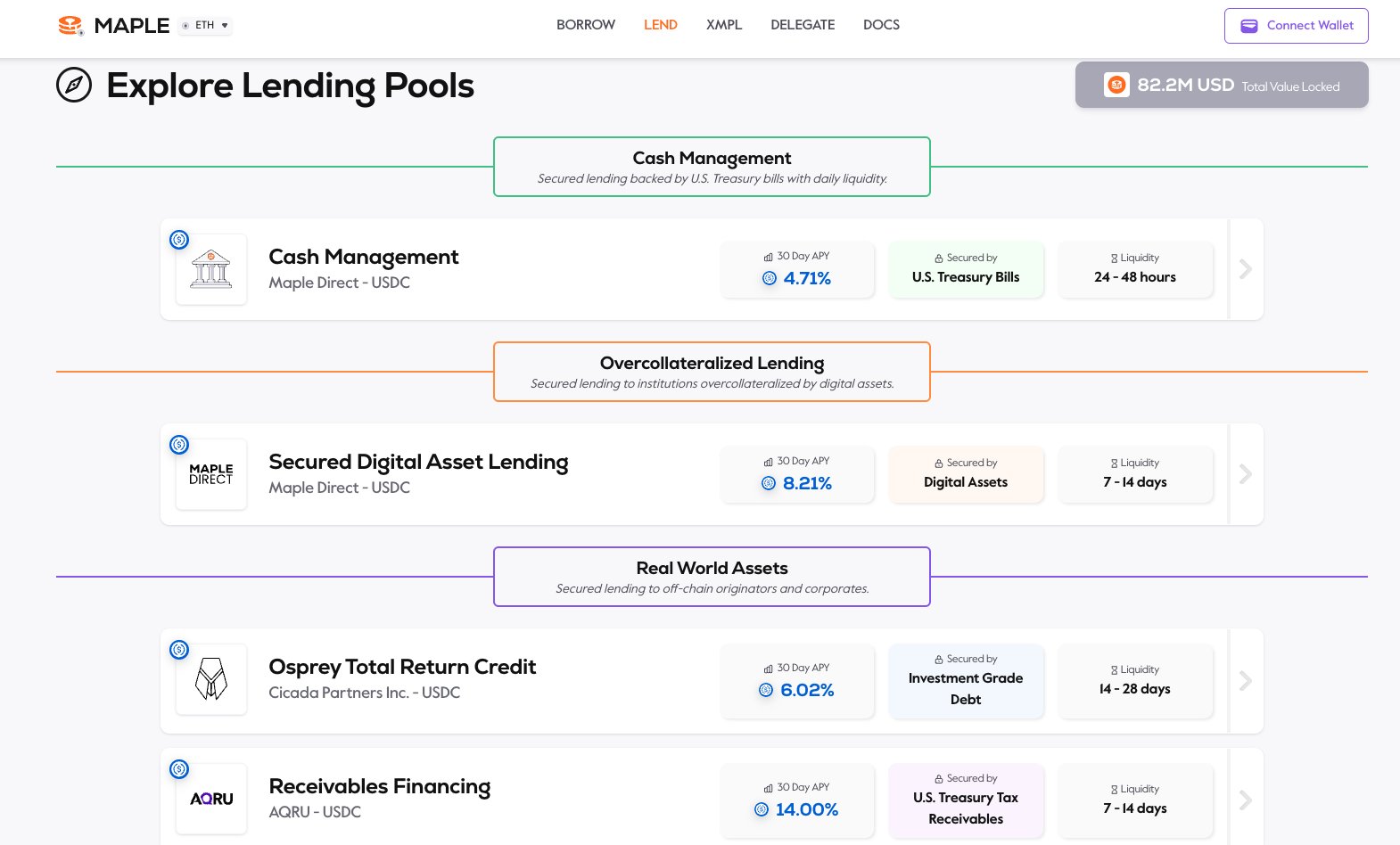

The protocol specializes in under-collateralized lending for KYC-compliant institutions and operates on Ethereum and Solana blockchains. It connects lenders with institutional borrowers and involves roles like Lenders, Borrowers, Pool Delegates, and Pool Cover providers. MPL and xMPL tokens are key to governance and revenue sharing. Maple 2.0 introduced open-term loans and automated lending processes.

Financial Products and Performance

Maple Finance offers cash management products in USDC/USDT, with returns around 4.28% to 4.55%. It's notable for its high total borrowed amount and default rates. The platform launched a $300 million credit fund for Bitcoin miners and a $40 million lending pool with borrowers like Wintermute, Auros, and Flow Traders.

Insurance Pool Cover

This feature acts as insurance for lending pools, with users depositing into an MPL-USDC pool on Balancer for first-loss capital.

Tokenomics

MPL is the governance token on Ethereum with a circulating supply of 7.9 million (79%) out of 10 million and a market cap of $105 million. xMPL is earned by staking MPL, used for governance and yield generation.

Challenges and Opportunities

Maple Finance faces regulatory uncertainties and the need for efficient collateral settlement in defaults, with the potential to redefine securitization processes and bridge traditional finance with crypto-assets.

Competitive Landscape and Future Outlook

Maple Finance competes with platforms like Centrifuge, Goldfinch, and Clearpool in the RWA space, positioned to lead in providing transparent, efficient financial solutions.

Altcoinist.com Verdict

Endorsements from industry giants like BlackRock, combined with Maple Finance's strategic move into the RWA market, underscore its potential in on-chain finance. By blending blockchain with traditional finance, Maple enhances efficiency and transparency, expanding into new lending pools to meet growing demand. With 79% of its MPL tokens circulating and over $100 million TVL, MPL presents a significant growth opportunity in the years ahead.