Altcoinist Review: $ZEPH by Zephyr Protocol - The CBDC Killer

“Central bank's digital currencies are the trojan horse for the ultimate totalitarian control in the world”

@lukebelmar

Over-collateralized Stable

CBDC killer (Untraceable)

Fair-launched

3 asset-model

In a dystopian future where digital currencies are dominated by CBDCs, the specter of total financial surveillance looms large.

In this world, every transaction and exchange is monitored under the unblinking eye of state control. Amidst this bleak landscape, $ZEPH emerges as a beacon of resistance.

Combining stability with privacy, $ZEPH defies the trend of total state control, championing individual autonomy and financial privacy.

Zephyr Protocol Launch

Achieved a pivotal hard fork on October 1st, 2023, marking the start of its private, decentralized, over-collateralized stablecoin system.

Background and Evolution

- Origin: Zephyr Protocol is a derivative of the Djed Protocol, collaboratively developed by Ergo Foundation, Emurgo, and IOHK. It's built on a Monero-based chain, inheriting comprehensive privacy features.

- Development: The protocol is a culmination of successful elements from SigmaUSD, COTI's Djed, and Milkomeda Djed Osiris Dollar (MOD), all demonstrating effective stablecoin strategies.

Technical Aspects

- Technology: Combining Djed Protocol mechanics with Monero's privacy attributes

- Zephyr operates on a three-asset model:

- ZEPH (Base Currency).

- ZEPHUSD (USD Stablecoin)

- ZEPHRSV (Reserve Currency).

- Innovations: ZephUSD is the private stablecoin, while ZephRSV acts as the reserve coin, correlated to the reserve ratio. This system ensures high stability and robust privacy.

- Performance and Scalability: The protocol builds on the principles of AgeUSD, proven to maintain stability amidst price volatility.

Tokenomics:

- $ZEPH's price: $37.81

- $ZEPH Market cap: $89M, rank #330

- Total Supply: 18.4 Million (before tail emission).

- Block Time: 120 seconds.

- Economic Model: The protocol's over-collateralization feature ensures stability, mitigating risks like bank runs while maintaining privacy and security.

- Mining Algorithm: RandomX proof-of-work (PoW), optimized for general-purpose CPUs.

- Emission Curve: Slower than Monero to reduce early adopter dilution and mitigate the inflationary impact on $ZEPH price.

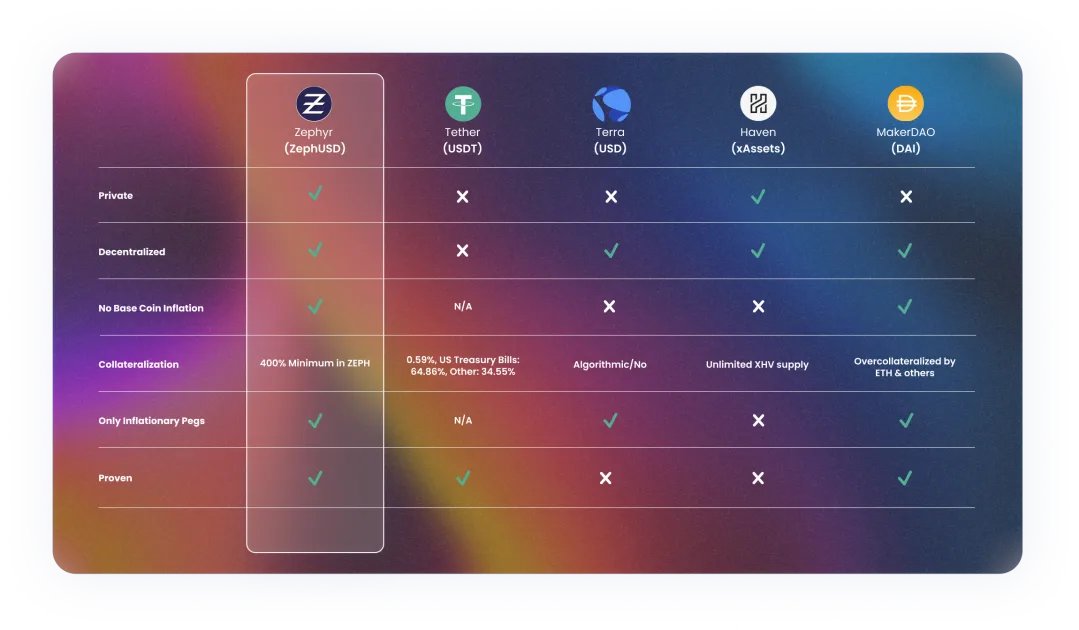

Key Features of $ZSD

- Privacy: Transactions have hidden amounts, recipient, and destination addresses.

- Decentralization: Operates independently of centralized entities.

- No Base Coin Inflation: Unlike algorithmic stablecoins, $ZSD doesn’t cause base coin inflation.

- Over-Collateralization: Requires more than 400% ZEPH in reserve to back each $ZSD.

- Proven Framework: Inspired by the Djed Protocol with successful implementations.

- Low Transaction Fees: Transfers cost less than a cent.

Zephyr Reserve Share ( $ZRS ) and Incentives

- Reserve Provider Role: Reserve Providers add ZEPH to the reserve, supporting the stability of $ZSD.

Incentives for Reserve Providers:

- Leveraged Position: Value appreciation of $ZEPH in reserve increases equity.

- Conversion Fees: Accrue as the protocol usage increases, bolstering reserve equity.

- Block Reward: A portion goes directly into the reserve, appreciating ZRS.

- Spot and MA Divergence: Protects against manipulation and benefits the reserve.

- Pseudo-Staking Reward: Concept for incentivizing $ZRS holders on Zephyr Protocol.

Protocol Performance and Reserve Ratio

- Reserve Ratio: Indicates the assets backing the circulating $ZSD. Currently, the ratio is significantly above the maximum for minting more ZRS.

- Healthy Reserve Indicator: A ratio above 800% demonstrates strong backing.

- $ZEPH Performance: Currently in a downturn, with initiatives to drive adoption and raise awareness.

- $ZRS Performance: Shows significant demand, driven by the block reward and increasing with protocol maturation.

Comparative Analysis with Other Stablecoins

- Stability Mechanism: Unlike algorithmic stablecoins, Zephyr avoids the pitfalls of a 'death spiral' by not relying on minting basecoins to maintain its peg, instead using a crypto-backed approach.

- Decentralization Focus: Emphasizing the importance of decentralization, Zephyr positions itself as an alternative to centralized stablecoins, potentially reducing systemic risks in the crypto ecosystem.

Current/Future Roadmap Items

- Exchange listings/partnerships (esp. for $ZSD)

- New Websites/Tools

- Mobile Wallets

- Oracle V2

- Fee Structure/Protocol tweaks

- Extended Djed + Protocol Overhaul research

Altcoinist.com Verdict

The Bet on a Resilient, Privacy-Focused Future

Zephyr Protocol $ZEPH emerges as an alternative in a financial future increasingly dominated by the control of Central Bank Digital Currencies (CBDCs).

Learning from Terra's $LUNA and UST shortcomings, $ZEPH is engineered with over-collateralization and bank-run resistance, ensuring enhanced stability and market resilience.

It is essential to mention that $ZEPH network mining has surpassed $XMR 's hash rate.

$ZEPH - $89M cap $XMR - $3B cap (33x)

A bet on Zephyr Protocol is a bet on a world where financial privacy still exists.

#DYOR here:

Medium:

https://medium.com/@zephyrcurrencyprotocol…

Website: https://zephyrprotocol.com

Explorer: https://explorer.zephyrprotocol.com

Network: https://network.zephyrprotocol.com

Web Wallet: https://network.zephyrprotocol.com

Twitter: https://twitter.com/zephyr_org

Discord: https://discord.gg/y4mzbDYSqQ

Telegram: https://t.me/zephyrprotocol

Github: https://github.com/ZephyrProtocol/Zephyr…

Whitepaper:https://zephyrprotocol.com/s/Zephyr_Whitepaper_v1.pdf